You can find the original article HERE.

Posted by Brier Dudley

Big Fish Games — one of Seattle’s largest independent game companies — has finally been sold.

The casual-gaming giant was acquired today by Churchill Downs in an $885 million deal, including $485 million upfront plus up to $350 million more depending on 2016 earnings. Big Fish founder Paul Thelen is eligible for $50 million through a performance bonus based on 2016 sales.

Louisville, Ky.-based Churchill Downs has diversified beyond its famed horse-racing facility into other gambling operations and online games.

Speculation about Big Fish selling or going public has persisted for years, especially since Seattle’s other casual-gaming giant, PopCap Games, sold in 2011 in a deal with Electronic Arts worth up to $1.3 billion.

Thelen started making games as a teenager because his family couldn’t get TV reception at their home outside Ellensburg. He went on to develop game-business plans for RealNetworks before starting Big Fish in 2002.

Big Fish grew into one of the world’s largest casual game companies, with around 500 employees at its headquarters on Seattle’s waterfront and around 600 worldwide. It creates and distributes games and by 2010 had handled more than 1 billion game downloads.

Paul Thelen, Big Fish image.

Over the past 12 months it had sales of $57.3 million, according to the announcement by Churchill Downs.

“The acquisition of Big Fish and our entry into the rapidly growing mobile and online games industry give us new products, new customers, new geographies and new sizable growth opportunities,” Bill Carstanjen, Churchill Downs chief executive, said in a release.

All Big Fish employees will be retained, according to Big Fish spokeswoman Susan Lusty. Further details will be provided in a Thursday conference call with investors. The deal is expected to close by the end of the year.

Big Fish and PopCap became phenomenal cash cows and twin pillars of the Seattle-centered casual game industry when it was dominated by downloadable games primarily played on computers.

With the rise of gaming on social networks, phones and tablets, the companies diversified their offerings and produced big hits on Apple devices. But their dominance faded as competition grew on the new platforms.

PopCap appears to have sold at a market peak, before Zynga’s disappointing public offering in late 2012 cast a pall over the sector.

Thelen pushed Big Fish into several new areas in 2012, including a short-lived cloud-gaming service. His best bet, though, was buying a small Oakland, Calif.-based studio that was making online casino games.

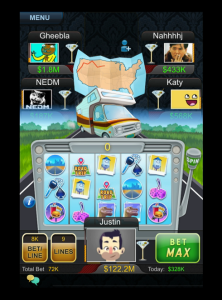

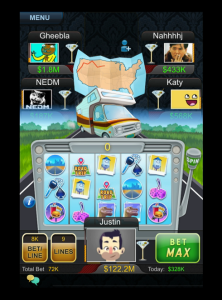

Big Fish Casino screenshot from Big Fish.

Casino-type games have become wildly successful, with players paying real money for virtual currency to spend on games like blackjack and slots. The category has also benefited from hints the Justice Department dropped in late 2012 that it may ease up on gambling restrictions and allow online games using real money in the U.S.

In 2013 “Big Fish Casino” was one of the top-grossing games on Apple’s iOS platform and helped Big Fish generate $266 million in sales that year.

To build online capabilities and position themselves for legalized online gambling, big gambling companies started shopping in Seattle. Double Down Interactive, which in 2012 operated the world’s largest online casino and one of the top games on Facebook, was acquired by Nevada-based International Game Technology in a deal worth up to $500 million.

Churchill Downs has diversified far beyond its namesake track, which opened in 1875. It now operates five tracks, six casinos, a video poker business and the online betting company TwinSpires.com, with 4,500 employees in 10 states. It’s also been building and buying online game platforms as part of a strategy to “broaden its focus and hedge its investment in its traditional domain of horse racing,” according to the company’s website.

Thelen declined to be interviewed but said in the release that “we are extremely proud of the company we have built over the last 12 years.”

“We believe Big Fish is now positioned to become an even greater force in the casual, mid-core and social casino mobile and online games industry,” he said. “Churchill Downs is a great cultural fit for us and we are thrilled to be joining the Churchill Downs family.”

Big Fish Games sold for up to $885 million

Posted by Brier Dudley

Big Fish Games — one of Seattle’s largest independent game companies — has finally been sold.

The casual-gaming giant was acquired today by Churchill Downs in an $885 million deal, including $485 million upfront plus up to $350 million more depending on 2016 earnings. Big Fish founder Paul Thelen is eligible for $50 million through a performance bonus based on 2016 sales.

Louisville, Ky.-based Churchill Downs has diversified beyond its famed horse-racing facility into other gambling operations and online games.

Speculation about Big Fish selling or going public has persisted for years, especially since Seattle’s other casual-gaming giant, PopCap Games, sold in 2011 in a deal with Electronic Arts worth up to $1.3 billion.

Thelen started making games as a teenager because his family couldn’t get TV reception at their home outside Ellensburg. He went on to develop game-business plans for RealNetworks before starting Big Fish in 2002.

Big Fish grew into one of the world’s largest casual game companies, with around 500 employees at its headquarters on Seattle’s waterfront and around 600 worldwide. It creates and distributes games and by 2010 had handled more than 1 billion game downloads.

Paul Thelen, Big Fish image.

Over the past 12 months it had sales of $57.3 million, according to the announcement by Churchill Downs.

“The acquisition of Big Fish and our entry into the rapidly growing mobile and online games industry give us new products, new customers, new geographies and new sizable growth opportunities,” Bill Carstanjen, Churchill Downs chief executive, said in a release.

All Big Fish employees will be retained, according to Big Fish spokeswoman Susan Lusty. Further details will be provided in a Thursday conference call with investors. The deal is expected to close by the end of the year.

Big Fish and PopCap became phenomenal cash cows and twin pillars of the Seattle-centered casual game industry when it was dominated by downloadable games primarily played on computers.

With the rise of gaming on social networks, phones and tablets, the companies diversified their offerings and produced big hits on Apple devices. But their dominance faded as competition grew on the new platforms.

PopCap appears to have sold at a market peak, before Zynga’s disappointing public offering in late 2012 cast a pall over the sector.

Thelen pushed Big Fish into several new areas in 2012, including a short-lived cloud-gaming service. His best bet, though, was buying a small Oakland, Calif.-based studio that was making online casino games.

Big Fish Casino screenshot from Big Fish.

Casino-type games have become wildly successful, with players paying real money for virtual currency to spend on games like blackjack and slots. The category has also benefited from hints the Justice Department dropped in late 2012 that it may ease up on gambling restrictions and allow online games using real money in the U.S.

In 2013 “Big Fish Casino” was one of the top-grossing games on Apple’s iOS platform and helped Big Fish generate $266 million in sales that year.

To build online capabilities and position themselves for legalized online gambling, big gambling companies started shopping in Seattle. Double Down Interactive, which in 2012 operated the world’s largest online casino and one of the top games on Facebook, was acquired by Nevada-based International Game Technology in a deal worth up to $500 million.

Churchill Downs has diversified far beyond its namesake track, which opened in 1875. It now operates five tracks, six casinos, a video poker business and the online betting company TwinSpires.com, with 4,500 employees in 10 states. It’s also been building and buying online game platforms as part of a strategy to “broaden its focus and hedge its investment in its traditional domain of horse racing,” according to the company’s website.

Thelen declined to be interviewed but said in the release that “we are extremely proud of the company we have built over the last 12 years.”

“We believe Big Fish is now positioned to become an even greater force in the casual, mid-core and social casino mobile and online games industry,” he said. “Churchill Downs is a great cultural fit for us and we are thrilled to be joining the Churchill Downs family.”

have a HELLUVA lot games there ...... safely stored for when I want them to replay ...

have a HELLUVA lot games there ...... safely stored for when I want them to replay ...